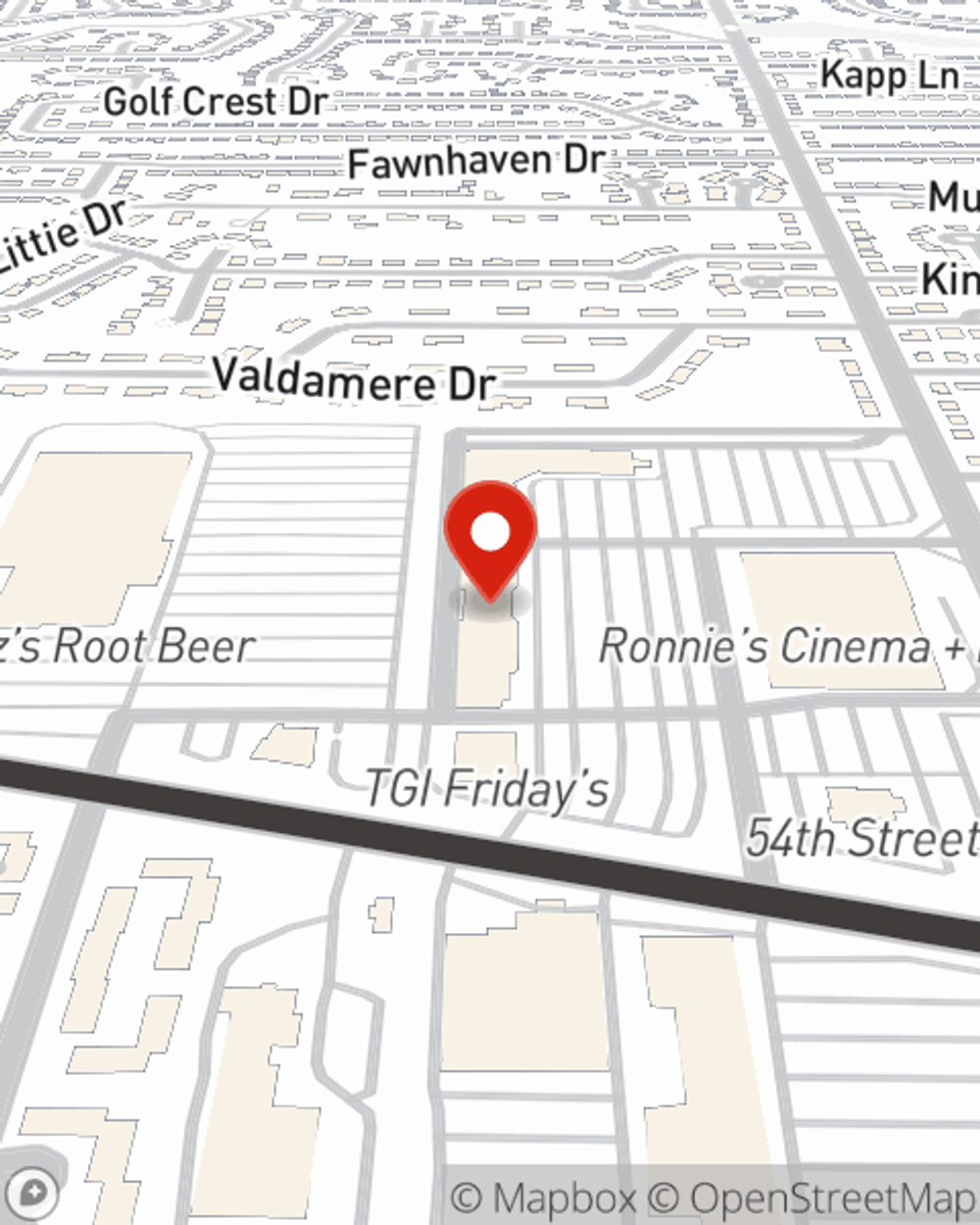

Business Insurance in and around St. Louis

One of the top small business insurance companies in St. Louis, and beyond.

Helping insure small businesses since 1935

- St. Louis County

- St. Louis City

- Sappington

- Sunset Hills

- Oakville

- Mehlville

- Arnold

- Imperial

- Barnhart

- Fenton

- Kirkwood

- Jefferson County

- South County

- Eureka

- Affton

- High Ridge

- House Springs

- Manchester

- Ballwin

- Chesterfield

- Cedar Hill

- Pevely

- Festus

- Herculaneum

Cost Effective Insurance For Your Business.

Whether you own a a stained glass shop, a home improvement store, or a hair salon, State Farm has small business insurance that can help. That way, amid all the different decisions and options, you can focus on what matters most.

One of the top small business insurance companies in St. Louis, and beyond.

Helping insure small businesses since 1935

Get Down To Business With State Farm

The passion you have to contribute to your community is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Brennen Sowa. With an agent like Brennen Sowa, your coverage can include great options, such as worker’s compensation, artisan and service contractors and business owners policies.

Since 1935, State Farm has helped small businesses manage risk. Call or email agent Brennen Sowa's team to identify the options specifically available to you!

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Brennen Sowa

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.