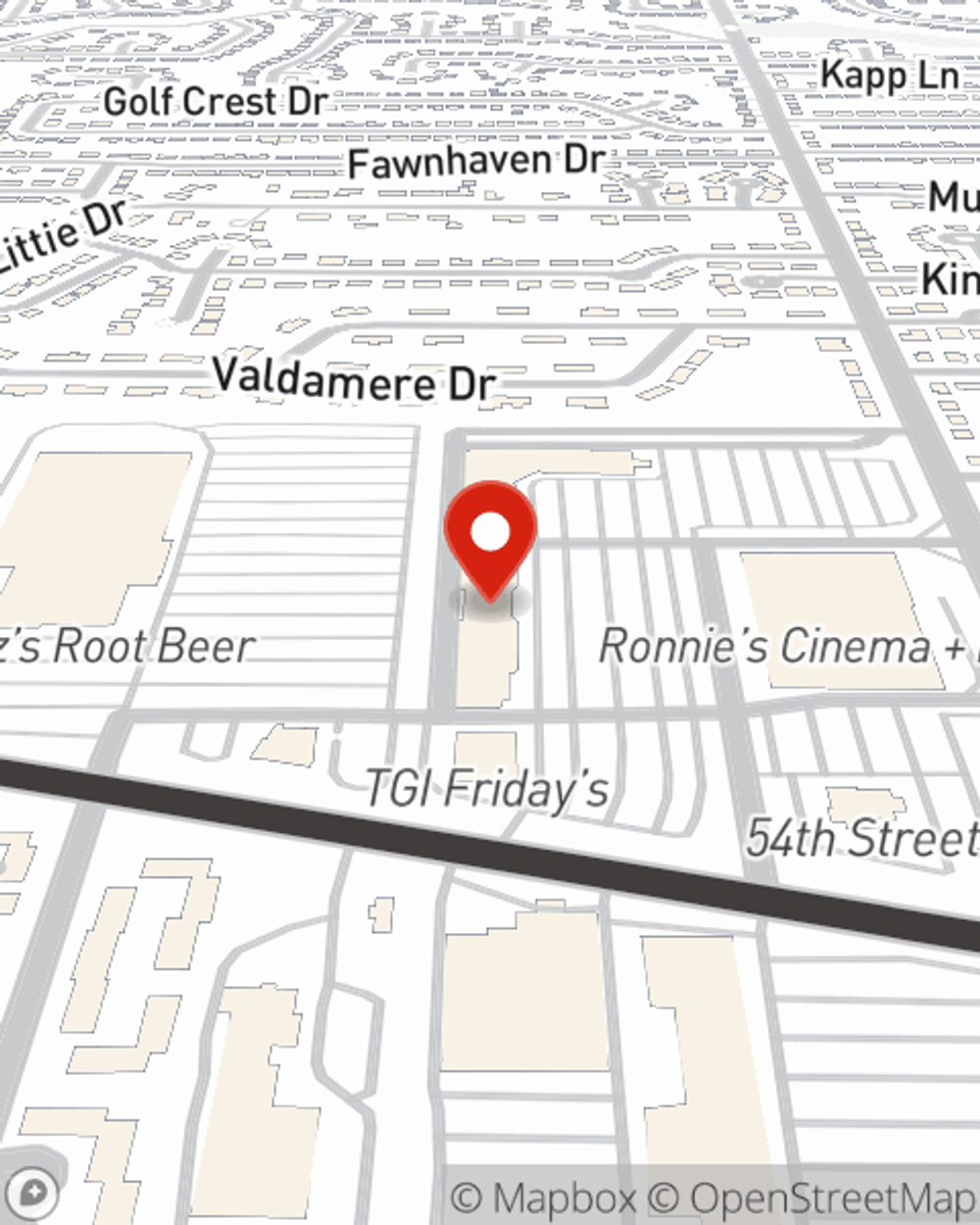

Auto Insurance in and around St. Louis

Discover your car insurance options from State Farm

Insurance that won't drive you up a wall

Would you like to create a personalized auto quote?

- St. Louis County

- St. Louis City

- Sappington

- Sunset Hills

- Oakville

- Mehlville

- Arnold

- Imperial

- Barnhart

- Fenton

- Kirkwood

- Jefferson County

- South County

- Eureka

- Affton

- High Ridge

- House Springs

- Manchester

- Ballwin

- Chesterfield

- Cedar Hill

- Pevely

- Festus

- Herculaneum

You've Got Places To Be. Let Us Help!

If "vehicle owner" describes you, auto insurance is your next step. And since that vehicle is no doubt a necessary piece of your daily routine, you'll want to make sure to choose the right amount of dependable coverage, as well as maximize your eligible savings. Don't worry, State Farm has options to fit your needs.

Discover your car insurance options from State Farm

Insurance that won't drive you up a wall

Protect Your Ride

With State Farm, get revved up for great auto coverage and savings options like comprehensive coverage emergency road service coverage, an anti-theft discount an older vehicle passive restraint safety feature discount, and more!

So don’t let hailstorms or theft stop you from moving forward!

Have More Questions About Auto Insurance?

Call Brennen at (314) 731-8189 or visit our FAQ page.

Simple Insights®

How to avoid door dings in parking lots

How to avoid door dings in parking lots

A door ding here, a dent or scratch there. Can they be avoided? State Farm® offers parking tips to help you avoid door dings.

Brennen Sowa

State Farm® Insurance AgentSimple Insights®

How to avoid door dings in parking lots

How to avoid door dings in parking lots

A door ding here, a dent or scratch there. Can they be avoided? State Farm® offers parking tips to help you avoid door dings.